are funeral expenses tax deductible in 2020

While the IRS allows deductions for medical expenses funeral. Unfortunately funeral expenses are not tax-deductible for individual taxpayers.

Families Can Get Reimbursed For Funeral Costs If They Lost A Loved One To Covid

Funeral expenses are not tax-deductible.

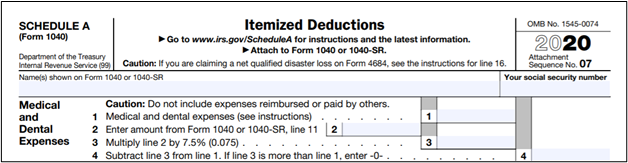

. The personal representative may file an amended return Form 1040-X for 2020 claiming the 500 medical expense as a deduction subject to the 75 limit. If the estate in question pays federal taxes they may be able to deduct the funeral expenses on a return if the estates funds were used for the funeral costs. Common deductible funeral costs include the casket embalmment or cremation burial plot gravestone and funeral service arrangements such as.

The cost of a funeral and burial can be deducted on a Form 1041 which is the final income tax return filed for a decedents estate or on the Form 706 which is the federal estate. These are considered to be personal expenses of the family members and attendees and funeral expenses are not deductible on personal income tax returns. For estates with a gross value of at least 1158 million tax-deductibility relies on how the funeral was paid for.

The ability to deduct funeral expenses on your tax returns depends on who paid for the funeral expenses. Funeral and burial expenses are only tax deductible if. However only estates worth over 1206 million are eligible for these tax.

The IRS does not levy taxes on most estates so only the most prosperous can benefit from tax deductions on their funeral expenses. I paid around 19000. The IRS deducts qualified medical expenses.

Unfortunately funeral expenses are not tax-deductible for individual taxpayers. Funeral expenses that are NOT tax-deductible are any which are not paid by the deceased persons estate. As stated by the IRS paying for funeral or cremation expenses out of your pocket is not tax-deductible.

IRS rules dictate that all estates worth. You can deduct expenses paid with estate funds. Is cremation tax deductible 2020.

The Internal Revenue Service IRS sets strict rules about what expenses can and cannot be deducted from your tax bill. Individual taxpayers cannot deduct funeral expenses on their tax return. If the funeral was paid for with.

Unfortunately funeral expenses are not tax-deductible for individual. This means that you cannot deduct the cost of a. Funeral Costs Paid by the Estate Are Tax Deductible.

No never can funeral expenses be claimed on taxes as a deduction. You may not take funeral expenses as a deduction on a personal income tax return. This means that you cannot deduct the cost of a funeral from your individual tax returns.

Funeral expenses are not tax deductible because they are not qualified. What funeral expenses are deductible. According to the IRS funeral expenses including cremation may be tax deductible if they are covered by the deceased persons estate.

According to the IRS website only medical expenses are tax deductible for individuals not the funeral or burial costs. If the amount is less than 1158 million you do not need to file a federal tax return so you cannot claim funeral expenses. When Can Funeral Costs Be Tax-Deductible.

Were sorry for your loss. Who cannot deduct funeral expenses. Funeral expenses are generally not tax-deductible unless the deceaseds estate pays for the costs.

In other words if you die and your heirs pay for the funeral. The 300 of expenses. What death expenses are tax deductible.

For most individuals this.

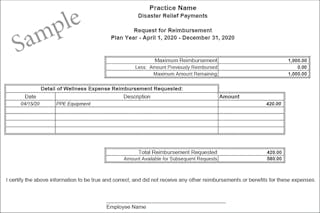

Employers May Make Tax Deductible Payments To Employees For Covid 19 Expenses Totem

Are Funeral Expenses Deductible The Official Blog Of Taxslayer

Are Funeral Expenses Tax Deductible All About Estate Taxes

Are Funeral Expenses Tax Deductible It Depends

Common Health Medical Tax Deductions For Seniors In 2022

Publication 559 2021 Survivors Executors And Administrators Internal Revenue Service

Fringe Benefits Rules For 2 S Corp Shareholders Cares Act Changes

Are Funeral Expenses Tax Deductible All About Estate Taxes

Are Funeral Expenses Tax Deductible Diversified Tax

Who Pays For Funeral Expenses Rochford Langins Jarstad

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Are Funeral Expenses Tax Deductible It Depends

Taxpayers Claim Nearly 17 000 Per Year In Medical Expenses

Utilize Tax Free Covid 19 Reimbursements For You And Your Staff Dental Economics

10 Tax Deductible Funeral Service Costs

Medical Deductions Deductible Medical Or Dental Expenses

Do You Qualify For A Home Office Tax Deduction While Working At Home